Much like a person who maxes out one credit card after another, the political fight over raising the United States’ debt ceiling does nothing but kick an uncomfortable can down the road.

The proverbial can in this sense is our over-consumptive spending. We have a country whose government spends more than it takes in. The Examiner reported this past April that the Congressional Budget Office projected revenues of $2.7 trillion in taxes for 2013 — the most in the country’s history — yet $800 billion short of its projected spending for the entire year.

The average American isn’t exactly handling debt responsibly, either. An article by NerdWallet analyzed federal government data, and concluded the average American carries $15,185 in credit card debt. The data nets the cumulative debt of the American population at $11.13 trillion — about two-thirds of the $16.7 trillion our government owes.

Regardless of how one feels about the growing national debt, the fact is that millions of Americans depend on Social Security, Medicare, veterans’ benefits, disability payments and military pay. For any government leader to even ponder not fulfilling those obligations is irresponsible, and treasonous by definition.

The real discussion that should take place is how to curb the growing national debt, while fulfilling its obligations to those that have been promised (or are owed) its support.

According to Jeffrey Dorfman, a contributor to Forbes, the United States can meet those obligations without a debt ceiling increase, and he shows how it’s possible using current tax revenues.

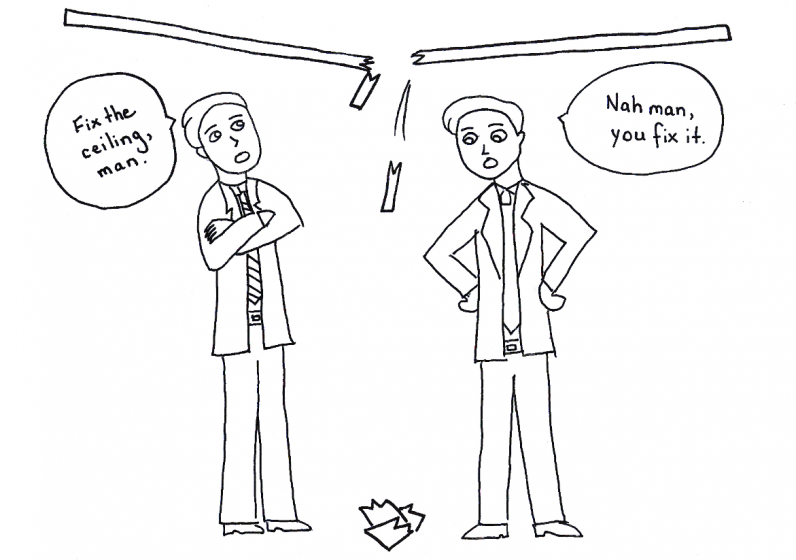

“In simple terms, the government would have to spend an amount less than or equal to what it earns,” said Dorfman. “Just like ordinary Americans have to do in their everyday lives.”

Though many Americans carry debt, most, if not all of us, have to make financial decisions about what is most important. Whether that be comfortably feeding ourselves and our families, paying for transportation to work or school, or making rent on time — our necessities dictate where our cash flows.

If the debt ceiling is not raised, that is not the end of the world. In that event, the government should reallocate its funds to make sure beneficiaries of Social Security, Medicare, veterans’ benefits, and other entitlements are taken care of. With millions of Americans depending on support many of them are owed, allowing that to fall through is not an option.

Like any responsible individual who manages their income and outflow of cash, our government needs to get it’s act together and act on behalf of its people. In our places of employment, if we frequently fail our employer, we lose our job. Likewise, the failure of our government to allow enough money to be spent on what it has already purchased signifies a need for change.

Millions of federal workers have already lost their income since Oct. 1 because of the government shutdown. It’s beyond time our government reopens it’s doors, end the debt ceiling debate, and agree to put Americans first.