COVID-19 causes financial insecurity

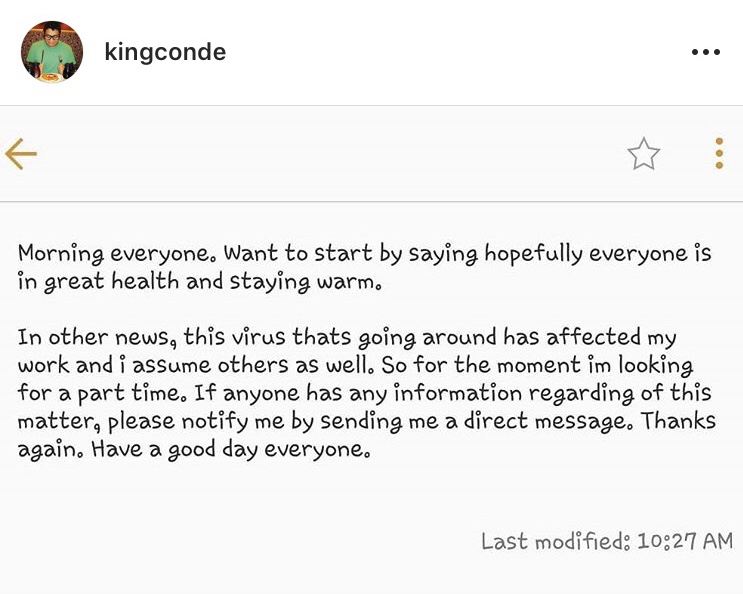

The first social media post on Pamela Estradas Instagram feed to indicate that employees are being impacted by COVID-19 goes up by Steven Conde.

Mar 18, 2020

There are so many questions as we flow into the next two weeks and one that is of great concern is will we be able to afford to stay isolated without financial income.

After the cancellation of events and gatherings at SF State, the talk and speculation of class cancellations turned into reality when late Monday night notice went out that all classes were cancelled for the remainder of the week. The hope to return after spring break came to a halt after notice was sent out that the semester was to continue online, via Zoom and iLearn.

These small changes experienced on campus are a small reflection of what the country is now experiencing. Email updates from the city about event cancellations began to trickle in. I received notice through email that Hamilton cancelled its remaining shows through March 31— I was really looking forward to it.

This all seems like a reasonable procedure to prevent further cases as it unfolds. We all get to stay home and finish assignments for the next two weeks as we tentatively wait to see how April will play out. Yet, that first Monday I wondered as a student who works on campus how that would impact my paycheck.

The first days of the closure had students, including me, reflecting over some of these concerns.

Relief came when Beth Hellwig, Interim Vice President of Student Affairs & Enrollment Management at SF State emailed out to staff that our paychecks would see no shortage.

“Student assistants may also continue working if they are in the area and choose to do so; however, all student assistants will continue to be paid for their regular hours, even if they choose not to work on campus,” read the email sent by Hellwig.

San Franciscans have seen the support of the city through moratorium on evictions, child care centers for parents on the front lines of the COVID-19 outbreak and low-income families, and has allowed premature access to vacation and paid sick leave to city employees.

Yet as we step into the reality the impact of job loss becomes real. Concerns of money begins to really hit home.

As I was scrolling on my Instagram a few days ago, I saw thatSteven Conde began his search for a new job.

“They told me Monday that productions slowed down. They are trying to give me a couple hours so I at least have some money coming in but that is still not enough,” explained Conde when describing his situation at Bites and Bashes, a small mom and pop business in Lomita,CA being impacted by the lack of business they have been receiving.

While this situation feels distant, it is relatable to so many beginning to undergo the same concerns. Not so far off campus, in ParkMerced, there are international students who cannot post to social media the need for a new job because the law won’t allow them to work off campus.

International students can only work on campus and in their case going home is not an option because of cost and their lease at ParkMerced. This also flows into territory of not getting what they paid for when they are now asked to continue to pay their very costly tuition but the quality of education is now affected.

As an international student from India, Navika Jindal a junior at SF State double majoring in Accounting and Information Systems, cannot work off campus yet to set up a backup plan since campus will not reopen after spring break.

“I sorta am [concerned with a possible continuous closure] at this point. If the campus closes down there is obviously nothing for me here. I work on campus and my classes are on campus,” says Jindal.

She moves to say that if taking the decision to go home to India would be taken it would be after great review of possible outcomes. Jindal says leaving would mean possible quarantine on arrival in India or extreme procedures countries are taking on international flights.

I get it we are doing the best we can with what we know and in order to keep people safe but at this point it is time to think of the financial breaks that need to happen after the semester. The cost of tuition should be cut for those that can show they are having a hard time paying for school to begin with. We aren’t funding the same programs we would be if we were in school. Interest on any loans should be removed. The only people that will take out loans are the ones really in trouble and it would suck having to pay on top of the help they already need.

“We are paying the university a lot of money. The first semester is about 10 thousand dollars, it would be beneficial to provide us some relief. If we wanted to do online classes we could have stayed home and done that—it’s much cheaper,” said Jindal.