A group of “meme” stocks, stocks that have been hyped up by trolls on the internet, have taken the internet by storm since January, with traders on social media continuing to encourage each other to invest in the booming NASDAQ underdog market.

Shares of video game retailer GameStop, which is at the forefront of the phenomenon, were up 41% on Monday, March 8. After gaining for four days straight, the stock was valued at $193.50 per share, the highest it’s been in five weeks. The gain came after news that Ryan Cohen, the founder of Chewy Inc., would be leading GameStop’s shift into e-commerce.

Shares of AMC Entertainment, another meme stock, were also up on Monday, closing at $9.13 – a 15.40% gain. GameStop shares continue to go up, despite the company’s 30% decline in 2020 sales and the closing of almost 700 stores.

Reports from The Wall Street Journal, New York Times and Washington Post just a few months ago detailed how the video game retailer was severely struggling, with potential further losses projected for the next fiscal quarter.

“A lot of investment firms looked at GameStop stock and decided that it was overvalued, meaning the price of a stock was higher than what they deemed it to be worth,” said Max Lee, assistant economics professor at SF State.

Lee explained that many Wall Street hedge fund firms bet that the GameStop stock would go down, assuming that the market would reflect the profitability of the company. Investors saw this as an opportunity to make a quick buck off the company’s misfortune by “short selling” the stock, a common practice by investors looking to turn a fast profit.

Short selling is a fairly simple concept. An investor borrows a stock — typically through a broker — at a low price in order to sell it at a higher price. The investor then waits for the price to drop again before buying the stock back to return it to the lender. Short selling is riskier than going long on a stock because, theoretically, there is no limit to how much an investor can lose, and eventually, no matter how the market is doing, the investor must return the borrowed stock to the lender.

In late January, traders on Reddit’s r/WallStreetBets platform caught wind of the investing trend. They organized to cause a GameStop short squeeze, a phenomenon in the stock market that occurs when there is not enough supply and too much demand for shares of a given stock.

Before the short squeeze, SF State BECA major Chase Evers got into trading on the mobile-app Robinhood through friends and online forums, including r/WallStreetBets. He said the forum was very different before the meme-stock craze, a place where amateur traders would casually share their experiences.

“It was more just people showing how much they’ve lost on certain stuff and showing the bets they’ve made – not so much rallying all behind one stock and shipping them out,” Evers said.

Because the forum, which was created in 2012, was relatively unassuming, many professional traders had no idea r/WallStreetBets investors were planning to shake up the market. The result was a surprise by the Redditors and a market that devolved into chaos. This short squeeze resulted in a cascade of stock purchases and an even bigger share price jump than usual.

At its peak on Jan. 28, the video game retailers’ shares grew by more than 14,300%, causing the company’s stock price to rise to the highest it had ever been. GameStop’s stock price reached a premarket value of over $500 per share, nearly 30 times the $17.25 valuation at the beginning of the month. The price of many other heavily shorted securities like AMC, Nokia, Blackberry and cryptocurrency Dogecoin also increased.

This short squeeze caused major financial consequences for certain hedge funds, pooled investment funds with limited partnership of investors, and large losses for short-sellers. Bandwagoners who jumped on to buy once GameStop was trending on Twitter also suffered losses; they bought in too late, when the shares were too high to turn a profit. Evers, who got in on GameStop stock pretty early in the game, also failed to make money off the short squeeze.

“I got scared and sold it the same day,” Evers said. “ I just sold for the same amount I bought it for.”

Many institutional investors were upset by the GameStop short squeeze and called for investors to sell their shares after seeing this genuine upheaval of the norms of investing.

Lee finds the whole GameStop short squeeze unsettling and questions what the implications of meme-stocks are.

“I think it sets a dangerous precedent in a way, because they kind of showed us that anyone can go and if they can get enough people they could potentially manipulate the market in the same way that has been done with GameStop,” Lee said.

Some brokerages, including Robinhood, halted the buying of GameStop and other trending securities during the height of the short squeeze on Jan. 28. The brokerages claimed they were unable to post sufficient collateral (a borrower’s pledge of specific property to a lender, to secure repayment of a loan) at clearing houses (intermediaries between buyers and sellers of financial instruments) to execute their clients’ orders.

“We had some calls on Nokia to go up,” Evers said. “And the morning that they were supposed to go up was the day that Robinhood shut down trading on all those stocks, basically just made them plummet, and then we all got fucked up from there.”

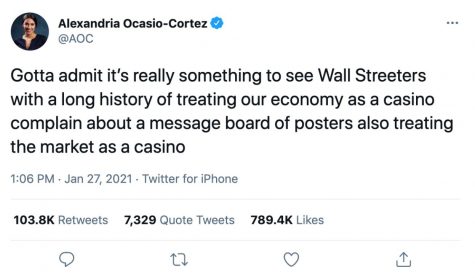

Robinhood’s decision to block certain stock purchases was widely criticized by politicians and business people, including Reps. Alexandria Ocasio-Cortez and Ro Khanna and Senator Ted Cruz.

During the controversy, Robinhood was accused of manipulating the market — which is illegal in most cases — as well as taking advantage of inexperienced traders, especially young people. The app is geared toward younger traders, with a quarter of users being first-time investors and an average age of 26.

Social media platforms TikTok and Twitter have influenced young people to start using Robinhood because it’s easy to navigate, more accessible than traditional trading methods and even has game-like features, such as virtual confetti and emoji-filled push notifications.

According to Lee, the app also makes it easier for young traders who don’t have a lot of money to invest in stocks.

“Oftentimes if you were to invest in stocks you might have to buy each share of stock, which could be upwards hundreds of dollars,” Lee said. “Whereas a lot of these new apps like Robinhood allow you to buy partial units of stock. So if you want to invest in Tesla, but you don’t have $850 to buy an entire stock, you can just buy a part of that stock.”

Despite the GameStop short sell craze skyrocketing and then plummeting over the course of only a few days, the whole ordeal continues to be an important topic of discussion, and the buzz around meme stocks is mounting.

Since Jan. 28, over 30 class-action lawsuits have been filed against Robinhood. Some complaints demand that the company pay damages for depriving its users of the chance to buy GameStop stock. Other lawsuits point out that users could only hold or sell the affected stocks as the share price for GameStop began to fall, benefiting short-sellers. Another lawsuit named all the major stock trading platforms, claiming they engaged in a conspiracy and violated antitrust laws by preventing retail investors from buying the stocks.

“In other words, Robinhood (and Apex Clearing Corporation) stole from the poor to give to the rich,” a separate class-action lawsuit filed in San Francisco reads.

On Feb. 18, a House committee with more than 50 members held a hearing about the GameStop short squeeze for five hours, during which Robinhood’s business model came under fire.

Vlad Tenev, co-founder and CEO of Robinhood, apologized for his company’s failings, but claimed they had broken no laws and didn’t prioritize Wall Street business partners over retail users.

“We don’t answer to hedge funds,” he said.

Rep. Sean Casten, Democrat of Illinois, accused Robinhood of having a history of taking advantage of inexperienced traders. He cited the case of 20-year-old Alex Kearns, who took his own life last June after mistakenly believing he’d lost nearly $750,000 in a risky bet on the app.

Despite the documented losses and known risks associated with volatile stocks, young people continue to trade in them.

Dogecoin was created as a joke in 2013, taking its name from the popular Shiba Inu dog meme and poking fun at the rise of Bitcoin. For literal cents, investors can buy shares of Dogecoin and participate in the internet’s newest wave of meme-stock mania. According to Twitter, the collective goal of Dogecoin traders is to drive up the stock price to one dollar – which will theoretically result in profits for everyone, provided they don’t buy too high and sell too low.

Just days after the GameStop short squeeze, Dogecoin’s value surged 600% within 24 hours. In the following weeks, billionaire Elon Musk tweeted a series of Dogecoin memes, each time sending the cryptocurrency’s value soaring for a few hours before eventually dropping again.

SF State marketing major Matteo Della Santina didn’t really participate in the GameStop short squeeze, but he decided to buy Dogecoin when his friend suggested him to invest.

“He blackmailed me into buying – just kidding,” Della Santina said. “No, he actually just was like, ‘you should buy Dogecoin’ and I put like, three bucks as a joke and ended up making $400, which is pretty stupid.”

Della Santina says he bought Dogecoin when it was worth $0.008. He spent $30, which bought him about 7,000 Dogecoin.

“I remember it hit a cent, and I was like, ‘whoa, wait a minute – I just made $300. That’s wild.’ And then it went up more, and I bought a little bit more on the way out,” Della Santina said. “Then I sold it and made 400 bucks.”

As of March 8, traders remain eager to rekindle the excitement that surrounded meme stocks back in January, and GameStop continues to be the trendiest retail stock on r/WallStreetBets. With Ryan Cohen leading the company’s transition into e-commerce, investors predict there will be more news about the stock to come.