The Board of Trustees choosing to raise tuition as enrollment decreases was a bad choice and didn’t do anything but increase the financial burden on students who already cannot afford college and the subsequent debt it leaves us with is a financial burden that follows many borrowers for decades. The real problem isn’t that students aren’t paying enough — it’s that the CSU needs to figure out their finances.

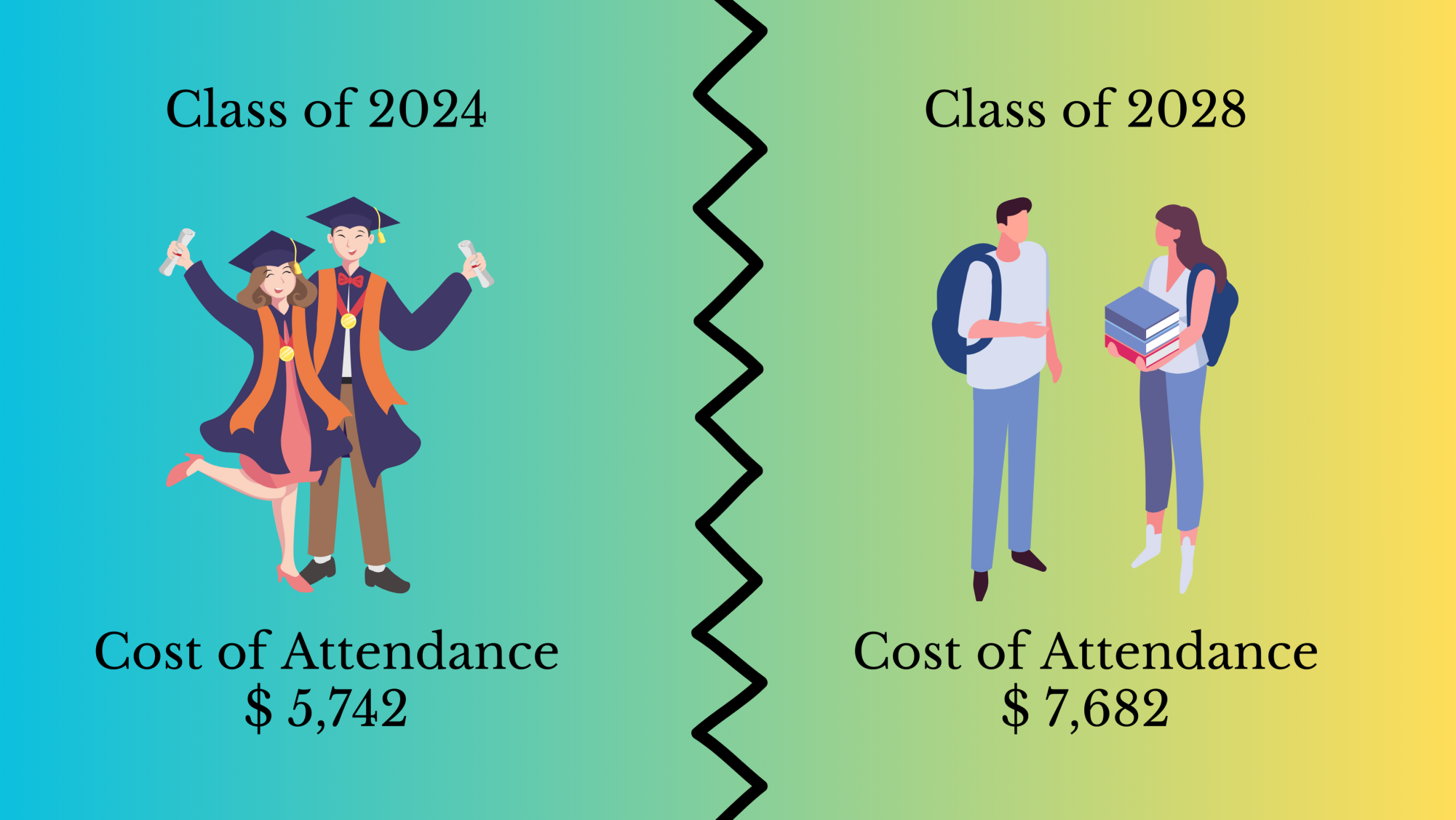

By the time my younger cousin, Kennedy Kirkland — who will begin school at California State University, Northridge this summer — graduates in 2029, annual tuition will balloon to $7,248 according to the tuition timeline on the CSU website.

The CSU system is located in one of the most expensive states in the country, and the best idea the Board of Trustees could come up with was to raise costs to make up for the slack that decreased enrollment causes. That doesn’t seem like the best business plan. Why is the onus of the CSU budget issues being placed on the backs of people whose lives are just getting started?

Simply looking at this from a business perspective, the math ain’t mathin’. Although I understand the importance of providing faculty, staff, and administrators with fair wages, it’s truly bewildering to consider that the upcoming generation of students, who will enter the workforce within the next decade, may face even greater debt burdens than those graduating this year. In 2023, the total amount of student debt in the U.S. was $1.7 trillion owed by 43.2 million borrowers.

The idea of raising tuition feels more like kicking the can down the road than addressing the ongoing issue of declining student enrollment. Students like Kirkland, who will graduate only four years after me, will potentially be subject to even more student debt than any generation before us. In a country with astronomically high student debt and a government actively opposed to student loan forgiveness, was this really the best decision?

How can we as a student body trust anything the board is doing when headlines like “Cal State says hoarding more than a billion dollars was ‘nothing nefarious.’ Yeah, right,” exist? We need to demand far more transparency or something seriously needs to change.

At this point, will higher education be worth the cost of attendance by the time my cousin graduates? With consumer prices steadily rising year after year, will she be able to afford to live in her home state after she has finished her stint in the CSU system?

“I don’t feel that good about it,” Kirkland said. “I mean, living in this economy is already bad enough. And people really don’t have the money for school.”

Last semester, I watched in horror as the CSU Board of Trustees voted to raise tuition systemwide by 6% every year for the next five years. I was heartbroken for all the students moving forward because the CSU system has always been able to boast that it is the most affordable option for higher education in the nation, and the people in charge seem to have forgotten how important that is.

If entities like the board continue to make decisions like this, the CSU will become less and less accessible to the same communities it once was meant to serve.

Is the board doing right by students in the CSU system? Is the board serving the students they are supposed to represent?

“For the past three, pretty much four years, they’ve lost ‘X’ amount of money, so they’re trying to pick up the slack by increasing the dollar amount?” said Edy Taylor, my cousin Kennedy’s mother. “Of course, they’re not gonna go back down. They’re just gonna keep increasing and keep increasing [the price].”

My little cousin will have paid significantly more in tuition than me by the time she walks the stage.

The bigger issue here is that increasing the cost of attendance means that interest rates will increase in tandem with the job market growing at a much slower pace. This cocktail of debt, interest, and stagnant wages will only make it more difficult for graduates to make a living in this country.

When will the straw break the proverbial camel’s back?

Documentaries about this subject have been made for decades. HBO’s Last Week Tonight with John Oliver has aired at least three segments related to the cost of education from multiple angles. Somehow — despite this fact — the message feels like it has largely fallen on deaf ears.

“I just don’t feel like it’s fair to the kids who are going to college now, the economy just gets higher and higher all the time. So it just gets harder to live every single year for people,” Kirkland said. “It’s already hard enough for kids to move out… get your own home, let alone pay all [this] student debt, and then it’s just getting higher and higher. It just doesn’t make sense.”

At the very least, the board could propose more solutions like increasing work-study programs or working with campuses to provide more part-time jobs to students. Yes, there are available financial aid options and some of these changes will not affect some of those students but it simply feels like it falls short of a real, long-term solution for not only the students but the CSU system as a whole.

The students of tomorrow will be worse off than the students of today, while the board kicks the can down the road by raising the price of tuition, which is more of a band-aid than an actual solution for their financial woes. At some point, there may no longer be a viable solution. We’ll have exhausted all our options, leaving behind disaffected adults with very little to celebrate come graduation.